FESTIVALS & EVENTS 12/31 New Years Eve at The Birches, Rockwood 1/2,9,16 Ski Clinics, Roberts Farm Preserve Norway 1/8 Red Bull Frozen Rush at Sunday River 1/17 Air Rifle Biathlon, Roberts Farm Preserve 1/21 Chili/Chowder Cook-off, Rangeley 1/21 Casino Night, Oquossoc 1/23 Rangeley Snodeo 1/23 B52 Commemorative Ride, Greenville 1/23-24 Mushers Bowl, Bridgton 1/23-24 Colby College Carnival 1/29-31 Moosehead Lake Togue Ice Fishing Derby 1/30 Quarry Road Winter Carnival, Waterville 1/30 Mt. Abram's Full Moon Hike & Ski  Population growth rate in Maine from 2000 to 2013 by County:

Source:http://www.inman.com/2015/10/22/infographic-the-fastest-growing-cities-in-america/?utm_source=20151023&utm_medium=email&utm_campaign=dailyheadlinesam FOCUS ON TRID: Advice from Linda Gifford, Maine Association of Realtors® Legal Counsel

Even if you have bought or sold property in the past, the rules and documentation is changing - As part of the changes, which stem from the merger of the Real Estate Settlement Procedures Act (RESPA) and the Truth in Lending Act (TILA), two new forms—the Loan Estimate and the Closing Disclosure—will replace the HUD-1 settlement form and the Good Faith Estimate. Samples of the new forms are available from the Consumer Financial Protection Bureau. What can you do to smooth out the process for your closing as the buyer or seller? The number one thing buyers and sellers can do is communicate, early and often with your real estate agent and with your lender (both buyers and sellers will be providing info to the buyer's lender or if your are having a cash sale, your title company or attorney). Your real estate agent will be communicating with you about the transaction and keeping you informed as to dates and timelines. Buyers: You should check in with the lenders you tend to use and see what their processes will be. How have they chosen to implement the disclosure process to you (the borrower)? What can you do to help? What does your agent suggest you put in your offer for days to close (we recommend 45-60 days) in your purchase and sale agreement? For more guidance from the CFPB: Click Here Points in the transaction where you can make a difference:

The Deb Barouch Team has extensive knowledge of the industry with over 30 years of experience. We know dependable loan officers, home inspectors, etc to help you through this process. Please contact us if you have any real estate needs! Deb Barouch Broker | Keller Williams Realty O: 207-553-2403 C: 207-838-4875 www.SearchMaineHomes.net www.MaineLuxuryPortfolioHomes.com www.SearchMaineCondos.com www.SearchMaineHomeValues.com Portland Landlords are required to register all rental units with Portland Housing Safety Office in 2016Beginning January 1, 2016, all Portland rental units MUST be registered annually with the City of Portland Housing Safety Office. The fine for failing to comply is $100 per unit per day.

Here is some information that you will find of interest if you rent out your condo or own an investment property in Portland: The registration form can be downloaded here: http://www.portlandmaine.gov/DocumentCenter/View/11080 The registration cost per unit is $35. There are discounts available for such things as having a fully sprinklered building, centrally monitored fire alarm, various inspections, and a "non-smoking" lease. Units must be registered annually, and within 30 days of purchasing the property. There are fines of up to $100 per day per unit for noncompliance. The rules applies to ALL rentals: Single family, casual rentals, AirBnB, vaction homes, weekend rentals, etc. The City intends to monitor internet advertisements on Craigslist and other sites.  Buyers are finally being able to take advantage of cooling trends in previously hot markets. Multiple offers are no longer being thrown at sellers as soon as the For Sale sign hits the front yard. Here's a tip about negotiating the best deal. Make sure you look at the big picture. In changing markets you should be planning to stay for at least five years, so don't get caught up in a $2,000 price difference. Remember, the goal is to get the house you want to live in for some time, not to impress friends with how you worked the previous owner. There was a significant amount of economic news released during the Thanksgiving holiday-shortened trading week. Overall, the economic data was strong enough to support the idea the Federal Reserve will likely pull the trigger on the first rate hike in nine years when the next rate decision is released on December 16.

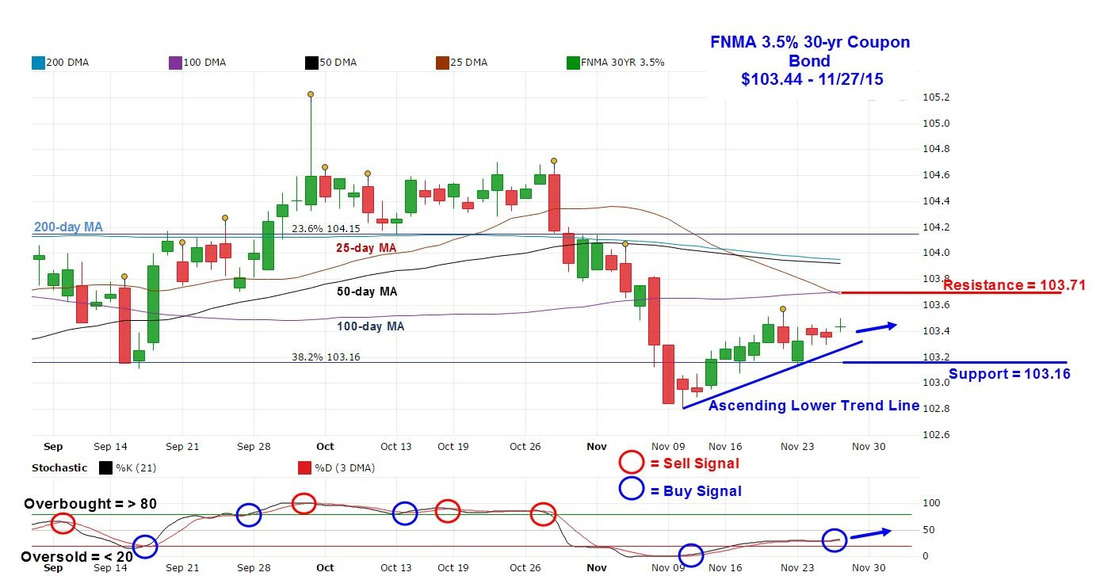

The week began with a report on home sales when the National Association of Realtors (NAR) reported Existing Home Sales declined 3.4% on a sequential basis in October, to a seasonally adjusted annualized rate of 5.36 million homes. However, Existing Sales were still 3.9% above the year-earlier figure. The consensus forecast had called for an annualized sales rate of 5.50 million homes. Overall, the median price of an existing home increased 5.8% to $219,600. NAR chief economist Lawrence Yun remarked “As long as solid job creation continues, a gradual easing of credit standards even with moderately higher mortgage rates should support steady demand and sales continuing to rise above a year ago.” For the week, the FNMA 30-year 3.5% coupon bond ($103.44, +12.5 bp) traded within a narrower 36 basis point range between a weekly intraday high of 103.50 and a weekly intraday low of $103.14 before closing at $103.44 on Friday. As projected last week, the bond traded mostly in a sideways direction between technical support located at the 38.2% Fibonacci retracement level at $103.16 and technical resistance located at the 100-day moving average at $103.71. The ascending lower trend line remains intact while the slow stochastic oscillator indicating market momentum has made a slight positive crossover while remaining far from “overbought” and this is a positive outcome. If the week’s employment data supports a December rate hike by the Federal Reserve we could see mortgage rates improve slightly. Chart: FNMA 30-Year 3.5% Coupon Bond Courtesy of:

Tamika Donahue Branch Manager, NMLS# 399388 Residential Mortgage Services 24 Christopher Toppi Drive South Portland, ME 04106 (207) 523-8416 (207) 749-4364 [email protected] www.RMSmortgage.com/TamikaDonahue  12/4 Village Holidays & Midnight Madness Sale, Bar Harbor 12/5 Rangeley Parade of Trees Community Party 12/6 Santa Sunday at Sunday River 12/6 Christmas Doubles/Lasagna Dinner at Woodland Valley, Limerick 12/6-12 Yarmouth Holiday Craft Show 12/19 Community Free Ski Day, Quarry Road Trails 12/19 Grand Opening Party, Big Squaw Mountain 12/26 Mt. Abram Full Moon Hike & Ski 12/31 New Years Eve at The Birches, Rockwood |

Deb BarouchWith over 30 years of experience helping Maine buyers & sellers! Reviews on Zillow 1908213 "Our family is planning to relocate to the Portland area from Maryland. We came to town for a weekend to explore the possibilities. Ms. Barouch spent ... more "  5.0/5.0 5.0/5.0 by user1199779 1890012 "Deb was great. Competent and caring-she worked hard to make everything go smoothly. She was easy to get in touch with-always quick to return our ... more "  5.0/5.0 5.0/5.0 by lenora gutwin 1574841 "Deb really works to help her clients. She knows the business very well and is readily available for questions or issues that arise. She also has a ... more "  5.0/5.0 5.0/5.0 by sgoodby Archives

June 2017

Categories

All

Keller Williams Realty |

|

Keller Williams Realty

Greater Portland 50 Sewall Street, 2nd Fl Portland, ME, 04102 |

|

Copyright © 2000-2015 Keller Williams ® Realty. - a real estate franchise company. All information provided is deemed reliable but is not guaranteed and should be independently verified. Properties subject to prior sale or rental. Each brokerage is independently owned and operated.

|

Proudly Designed by: eAgentCreative

|

RSS Feed

RSS Feed