|

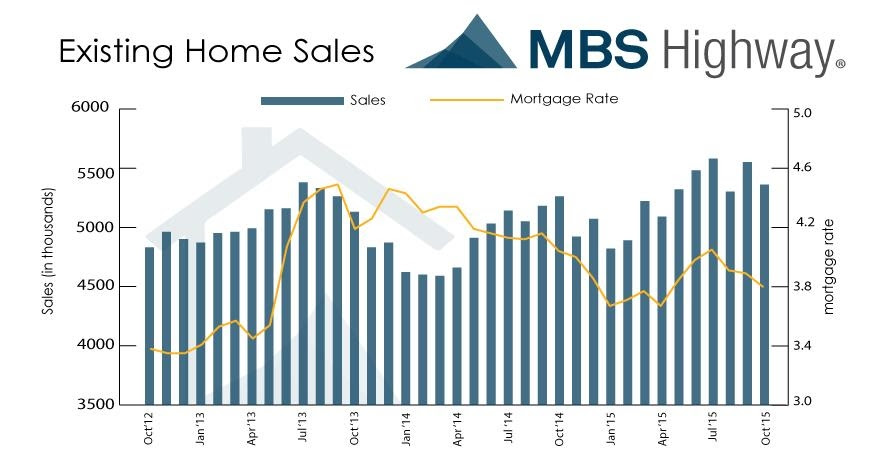

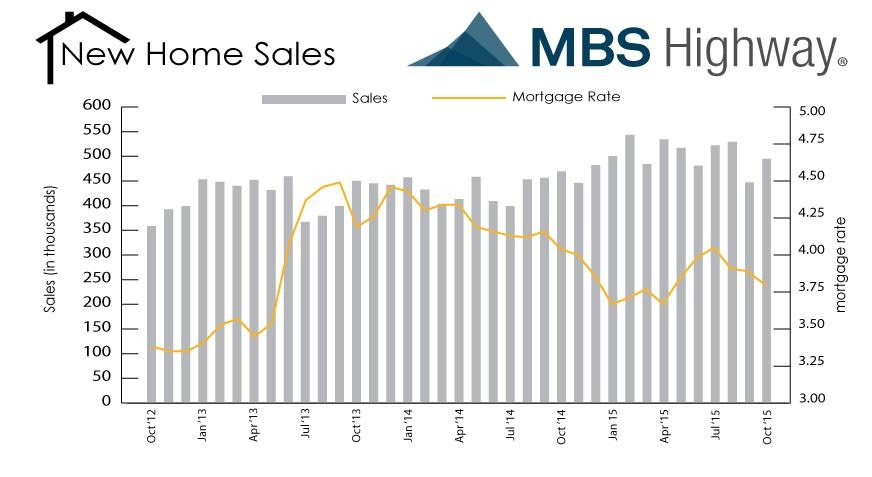

There was a significant amount of economic news released during the Thanksgiving holiday-shortened trading week. Overall, the economic data was strong enough to support the idea the Federal Reserve will likely pull the trigger on the first rate hike in nine years when the next rate decision is released on December 16. The week began with a report on home sales when the National Association of Realtors (NAR) reported Existing Home Sales declined 3.4% on a sequential basis in October, to a seasonally adjusted annualized rate of 5.36 million homes. However, Existing Sales were still 3.9% above the year-earlier figure. The consensus forecast had called for an annualized sales rate of 5.50 million homes. Overall, the median price of an existing home increased 5.8% to $219,600. NAR chief economist Lawrence Yun remarked “As long as solid job creation continues, a gradual easing of credit standards even with moderately higher mortgage rates should support steady demand and sales continuing to rise above a year ago.” Additionally, the latest S&P/Case Shiller 20-city Home Price Index increased 5.5% year-over-year in September at the fastest rate in 13 months as a lower inventory of houses for sale has forced buyers to bid up available properties. The consensus forecast had called for a 5.2% rise. Overall, home sales have risen 3.9% in the past 12 months while the number of available homes has declined 4.5%. Furthermore, the Census Bureau and the Department of Housing and Urban Development reported New Home Sales increased to a seasonally adjusted annual rate of 495,000 in October, an increase of 10.7% from a downwardly revised September rate of 447,000 and an increase of 4.9% compared with the October 2014 rate of 472,000. The consensus forecast had called for a rate of 504,000. The Census Bureau also reported the median sales price for new homes sold in October fell by more than $15,000 from $296,900 in September to $281,500, and the average sales price rose by about $2,000 to $366,000. At the end of October, the number of new homes for sale totaled 226,000 to represent a supply of 5.5 months at the current sales rate. As for mortgages, the Mortgage Bankers Association released their latest Mortgage Application Data for the week ending November 21 showing the overall Market Composite Index decreased 3.2%. The Refinance Index decreased 5.0% from the prior week, while the seasonally adjusted Purchase Index decreased by 1.0% from a week earlier. Overall, the refinance portion of mortgage activity decreased to 58.7% of total applications from 58.6%. The adjustable-rate mortgage segment of activity increased to 6.4% of total applications from 6.3% the prior week. The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balance fell from 4.18% to 4.14%.

For the week, the FNMA 3.5% coupon bond gained 12.5 basis points to end at $103.44 while the 10-year Treasury yield decreased 4.2 basis points to end at 2.22%. Stocks ended the week with the NASDAQ Composite gaining 22.61 points to close at 5,127.53. The Dow Jones Industrial Average fell 25.32 points to end at 17,798.49, and the S&P 500 increased fractionally, 0.94 of a point, to close at 2,090.11. Year to date, and exclusive of any dividends, the NASDAQ Composite has gained 7.63%, the Dow Jones Industrial Average has lost 0.138%, and the S&P 500 has added 1.49%. This past week, the national average 30-year mortgage rate was unchanged at 4.00% while the 15-year mortgage rate edged higher to 3.25% from 3.24%. The 5/1 ARM mortgage rate increased to 3.00% from 2.97%. FHA 30-year rates remained unchanged at 3.75% while Jumbo 30-year rates increased to 3.84% from 3.83%.

0 Comments

Leave a Reply. |

Deb BarouchWith over 30 years of experience helping Maine buyers & sellers! Reviews on Zillow 1908213 "Our family is planning to relocate to the Portland area from Maryland. We came to town for a weekend to explore the possibilities. Ms. Barouch spent ... more "  5.0/5.0 5.0/5.0 by user1199779 1890012 "Deb was great. Competent and caring-she worked hard to make everything go smoothly. She was easy to get in touch with-always quick to return our ... more "  5.0/5.0 5.0/5.0 by lenora gutwin 1574841 "Deb really works to help her clients. She knows the business very well and is readily available for questions or issues that arise. She also has a ... more "  5.0/5.0 5.0/5.0 by sgoodby Archives

June 2017

Categories

All

Keller Williams Realty |

|

Keller Williams Realty

Greater Portland 50 Sewall Street, 2nd Fl Portland, ME, 04102 |

|

Copyright © 2000-2015 Keller Williams ® Realty. - a real estate franchise company. All information provided is deemed reliable but is not guaranteed and should be independently verified. Properties subject to prior sale or rental. Each brokerage is independently owned and operated.

|

Proudly Designed by: eAgentCreative

|

RSS Feed

RSS Feed