|

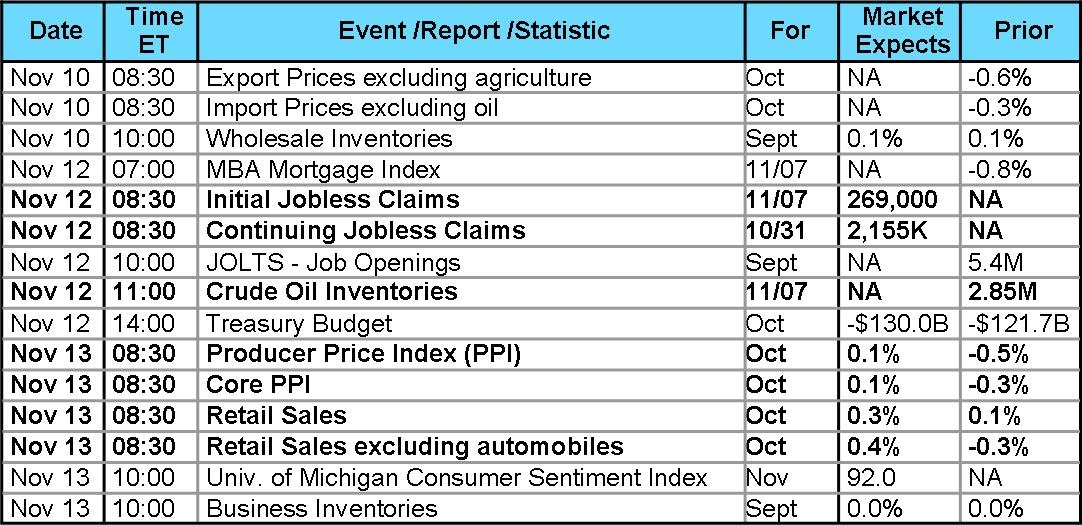

Courtesy of: Tamika Donahue Weekly Review - for the week of November 2, 2015 It was not a good week for the bond market including mortgage bonds. After a slight move lower on Monday, it was all downhill for the bond market with traders exerting caution ahead of Friday’s release of the October Employment Situation Summary (jobs report). The week’s economic news showed the nation’s labor situation seems to be significantly improving. Wednesday’s ADP Employment Change report set the stage for Friday’s jobs data. According to the ADP Employment Change report there were 182,000 private sector jobs added to the economy in October. This jobs total was slightly above the consensus forecast of 180,000 jobs. Also on Wednesday, Federal Reserve Chair Yellen provided a “surprise” to the financial markets during testimony before the House Financial Services Committee, saying the Fed could raise interest rates at its next FOMC meeting on December 16. If so, it would be the first rate hike in almost a decade. Yellen told the Committee "At this point, I see the U.S. economy as performing well. The committee (FOMC) does feel that moving in a timely fashion -- if the data and the outlook justify such a move -- is a prudent thing to do.” Yellen contended that raising interest rates by year end rather than waiting would allow the Fed to gradually raise rates. If the Fed waited too long, it might be forced to raise rates at a quicker pace and that might shock the stock market. Yellen stated "It's been a long time that interest rates have been at zero. Markets and the public should be thinking about the entire path of policy rates over time...that will be a very gradual path." When Friday arrived, both the bond and stock markets were subjected to selling pressure for much of the session following a significantly stronger than forecast October jobs report. The jobs data made it far more likely the Federal Reserve will raise interest rates in December. The U.S. Bureau of Labor Statistics reported total Nonfarm Payroll employment increased by 271,000 in October while the Unemployment Rate was essentially unchanged at 5.0%. This far exceeded the consensus forecast of 181,000 jobs with an unemployment rate of 5.1%. Furthermore, the change in total nonfarm payroll employment for August was revised higher from 136,000 to 153,000, and the change for September was revised lower from 142,000 to 137,000. With these revisions, employment gains in August and September combined were 12,000 more than previously reported. Over the past three months, job gains have averaged 187,000 per month. In housing, the Mortgage Bankers Association released their latest Mortgage Application Data for the week ending October 24 showing the overall Index fell 0.8%. The Refinance Index dropped 1.0% from the prior week, while the seasonally adjusted Purchase Index decreased by 1.0% from a week earlier. Overall, the refinance portion of mortgage activity increased to 59.7% of total applications from 59.5%. The adjustable-rate mortgage segment of activity increased to 6.7% of total applications from 6.6% the prior week. The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balance rose from 3.98% to 4.01%. For the week, the FNMA 3.5% coupon bond lost 81.2 basis points to end at $103.30 while the 10-year Treasury yield increased 17.9 basis points to end at 2.33%. Stocks ended the week with the NASDAQ Composite gaining 93.37 points to close at 5,147.12. The Dow Jones Industrial Average increased 246.79 points to end at 17,910.33, and the S&P 500 added 19.84 points to close at 2,099.20. Year to date, and exclusive of any dividends, the NASDAQ Composite has gained 7.99%, the Dow Jones Industrial Average has added 0.49%, and the S&P 500 has risen 1.92%. This past week, the national average 30-year mortgage rate increased to 4.04% from 3.90% while the 15-year mortgage rate increased to 3.27% from 3.19%. The 5/1 ARM mortgage rate increased to 2.95% from 2.94%. FHA 30-year rates remained unchanged at 3.75% while Jumbo 30-year rates increased to 3.85% from 3.71%. Mortgage Rate Forecast with Chart For the week, the FNMA 30-year 3.5% coupon bond ($103.30, -81.2 bp) traded within a wider 101 basis point range between a weekly intraday high of 104.14 and a weekly intraday low of $103.13 before closing at $103.28 on Friday. Friday, the bond plunged below primary support at the 100-day moving average at $103.66 and secondary support located at the 38.2% Fibonacci retracement level at $103.16 before bouncing back off of its worst levels of the day. The $103.16 level now becomes primary support while the 100-day moving average now becomes nearest overhead resistance. The “slow” stochastic oscillator measuring market momentum has totally flat-lined and can’t move any lower with a current reading of zero. Therefore, any price move higher by mortgage bonds this coming week will trigger a new buy signal. Should this occur, we should see a slight improvement in mortgage rates. Chart: FNMA 30-Year 3.5% Coupon Bond  Economic Calendar - for the Week of November 9, 2015 The economic calendar features the weekly Initial Jobless Claims, Producer Price Index and Retail Sales reports as the most likely to impact the financial markets this coming week. Economic reports having the greatest potential impact on the financial markets are highlighted in bold. Federal Reserve FOMC Meeting Schedule Upcoming Federal Reserve FOMC Meeting Schedule & Rate Hike Probability**

* Meeting associated with a Summary of Economic Projections and a press conference by the Chairman. ** Probability generated from the CME Group FedWatch tool based on the 30-day Fed Funds futures prices. Tamika Donahue Branch Manager, NMLS# 399388 Residential Mortgage Services 24 Christopher Toppi Drive South Portland, ME 04106 (207) 523-8416 (207) 749-4364 [email protected] www.RMSmortgage.com/TamikaDonahue

0 Comments

Leave a Reply. |

Deb BarouchWith over 30 years of experience helping Maine buyers & sellers! Reviews on Zillow 1908213 "Our family is planning to relocate to the Portland area from Maryland. We came to town for a weekend to explore the possibilities. Ms. Barouch spent ... more "  5.0/5.0 5.0/5.0 by user1199779 1890012 "Deb was great. Competent and caring-she worked hard to make everything go smoothly. She was easy to get in touch with-always quick to return our ... more "  5.0/5.0 5.0/5.0 by lenora gutwin 1574841 "Deb really works to help her clients. She knows the business very well and is readily available for questions or issues that arise. She also has a ... more "  5.0/5.0 5.0/5.0 by sgoodby Archives

June 2017

Categories

All

Keller Williams Realty |

|

Keller Williams Realty

Greater Portland 50 Sewall Street, 2nd Fl Portland, ME, 04102 |

|

Copyright © 2000-2015 Keller Williams ® Realty. - a real estate franchise company. All information provided is deemed reliable but is not guaranteed and should be independently verified. Properties subject to prior sale or rental. Each brokerage is independently owned and operated.

|

Proudly Designed by: eAgentCreative

|

RSS Feed

RSS Feed