|

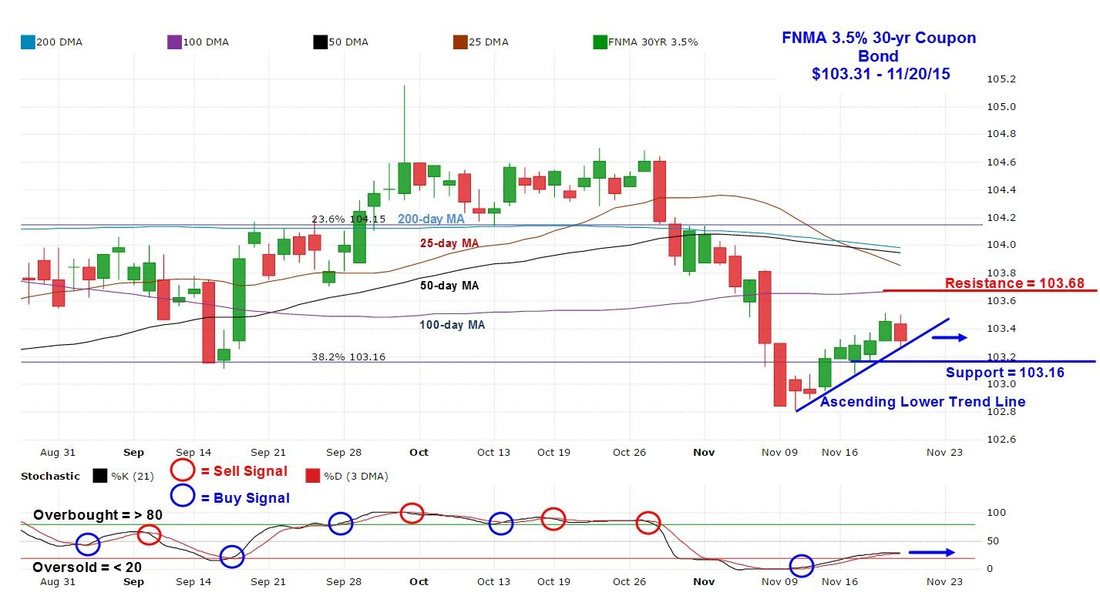

For the week, the FNMA 30-year 3.5% coupon bond ($103.31, +12.5 bp) traded within a narrower 44 basis point range between a weekly intraday high of 103.52 and a weekly intraday low of $103.08 before closing at $103.31 on Friday. After trending higher Monday through Thursday, the bond reversed course on Friday in a move toward support located at the 38.2% Fibonacci retracement level at $103.16. Friday’s negative action sent the bond lower to touch its ascending lower trend line. This line is formed by connecting the intra-day lows from the low on November 10 onward to form the lower trend line. A break below this line would be considered a bearish event. The slow stochastic oscillator is showing a loss of momentum and is flattening out, suggesting the bond could subsequently trade sideways and be range-bound between support and resistance located at the 100-day moving average at $103.67. As a result, we shouldn’t see much change in rates this coming Thanksgiving holiday week that will be characterized by lower than average trading volume. Chart: FNMA 30-Year 3.5% Coupon Bond

0 Comments

Leave a Reply. |

Deb BarouchWith over 30 years of experience helping Maine buyers & sellers! Reviews on Zillow 1908213 "Our family is planning to relocate to the Portland area from Maryland. We came to town for a weekend to explore the possibilities. Ms. Barouch spent ... more "  5.0/5.0 5.0/5.0 by user1199779 1890012 "Deb was great. Competent and caring-she worked hard to make everything go smoothly. She was easy to get in touch with-always quick to return our ... more "  5.0/5.0 5.0/5.0 by lenora gutwin 1574841 "Deb really works to help her clients. She knows the business very well and is readily available for questions or issues that arise. She also has a ... more "  5.0/5.0 5.0/5.0 by sgoodby Archives

June 2017

Categories

All

Keller Williams Realty |

|

Keller Williams Realty

Greater Portland 50 Sewall Street, 2nd Fl Portland, ME, 04102 |

|

Copyright © 2000-2015 Keller Williams ® Realty. - a real estate franchise company. All information provided is deemed reliable but is not guaranteed and should be independently verified. Properties subject to prior sale or rental. Each brokerage is independently owned and operated.

|

Proudly Designed by: eAgentCreative

|

RSS Feed

RSS Feed