|

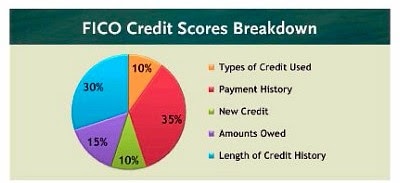

DID YOU KNOW? Improving your credit score may save you money on your home financing. That's because higher FICO (Fair Isaac Credit Organization) scores typically result in better interest rates. There are also industry and lender level guidelines relative to a borrower's credit ratings and history that help determine: Your qualification for certain loan programs. Your capacity to repay the loan. Your interest rate. HOW FICO CREDIT SCORES WORK FICO scores are the credit scores most lenders use to determine your credit risk. You have three FICO scores, one for each of the three credit bureaus - Experian, Equifax, and TransUnion. Each credit score is based on information the credit bureau keeps on file about you. As this information changes, your credit score will change as well.

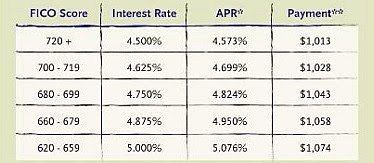

FICO CREDIT SCORES BREAKDOWN The examples shown below are all calculated on a Sales Price of $250,000 with a 20% Down Payment of $50,000 for a Loan Amount of $200,000 as a 30 Year Fixed Rate and Term: *APR = Annual Percentage Rate **Monthly Payment does not include taxes or insurance

Tamika Donahue [email protected] Bart English [email protected] www.RMSmortgage.com

1 Comment

|

Deb BarouchWith over 30 years of experience helping Maine buyers & sellers! Reviews on Zillow 1908213 "Our family is planning to relocate to the Portland area from Maryland. We came to town for a weekend to explore the possibilities. Ms. Barouch spent ... more "  5.0/5.0 5.0/5.0 by user1199779 1890012 "Deb was great. Competent and caring-she worked hard to make everything go smoothly. She was easy to get in touch with-always quick to return our ... more "  5.0/5.0 5.0/5.0 by lenora gutwin 1574841 "Deb really works to help her clients. She knows the business very well and is readily available for questions or issues that arise. She also has a ... more "  5.0/5.0 5.0/5.0 by sgoodby Archives

June 2017

Categories

All

Keller Williams Realty |

|

Keller Williams Realty

Greater Portland 50 Sewall Street, 2nd Fl Portland, ME, 04102 |

|

Copyright © 2000-2015 Keller Williams ® Realty. - a real estate franchise company. All information provided is deemed reliable but is not guaranteed and should be independently verified. Properties subject to prior sale or rental. Each brokerage is independently owned and operated.

|

Proudly Designed by: eAgentCreative

|

RSS Feed

RSS Feed